MLRO CPD Programme 2025

Overview

The Money Laundering Reporting Officer (MLRO) CPD Programme is designed to support MLROs, Deputy MLROs, Compliance staff and other FCC professionals to keep up to date with the latest industry and regulatory developments and assist with their ongoing professional development in relation to Financial Crime prevention.

This 12-month MLRO CPD Programme is designed and delivered by experienced, former practitioners and is ideal for professionals working within the financial services industry. It covers the key regulatory topics, including business and customer risk related to money laundering, terrorist financing and proliferation financing, sanctions, fraud, and bribery & corruption.

The programme consists of 12 x 1-hour live tutorials (taking place once per month), and 4 optional eLearning modules, totalling 15 CPD hours.

Participants have the flexibility of attending sessions live as they take place, or at a later date by watching the recordings on-demand through our dedicated CPD learning portal.

This MLRO CPD Programme is intended to provide CPD support to MLROs in any jurisdiction, by focusing on common themes, challenges and best practices. When you join the programme, you will also be given 12 months of access to our learning portal, the Virtual Compliance Mentor, (including archived tutorial recordings and a host of other learning resources).

Who is this for?

This course has been designed for MLRO’s and those working in financial crime prevention roles. The programme will also be of interest to legal, audit and risk staff within the financial services industry as well as Regulators. Staff who are new to financial crime prevention and compliance and want to keep up to date with the latest trends will also find this course useful.

Course Details

- The role of the MLRO – an overview

- Applying the FATF approach to risk – threats, vulnerabilities, impacts

- The MLRO and the business wide risk assessment

- Demonstrating the effectiveness of the financial crime programme

- Identifying and categorising customer risk

- The challenge of PEPs

- A focus on identifying and investigating suspicions

- Ongoing monitoring of financial crime controls

- The importance of risk-based and role-based training

- Identifying and managing sanctions risk

- Identifying and managing bribery and corruption risk

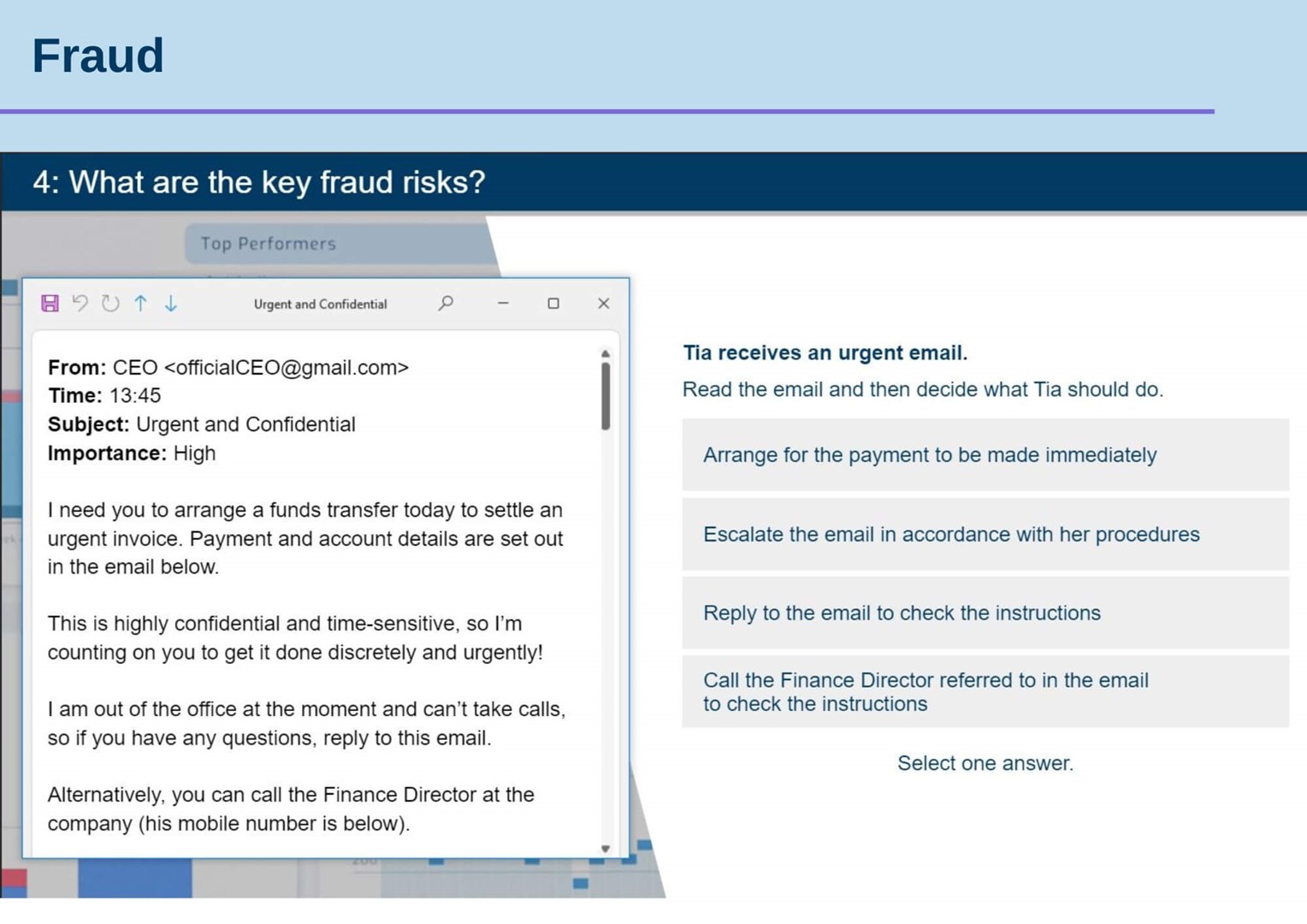

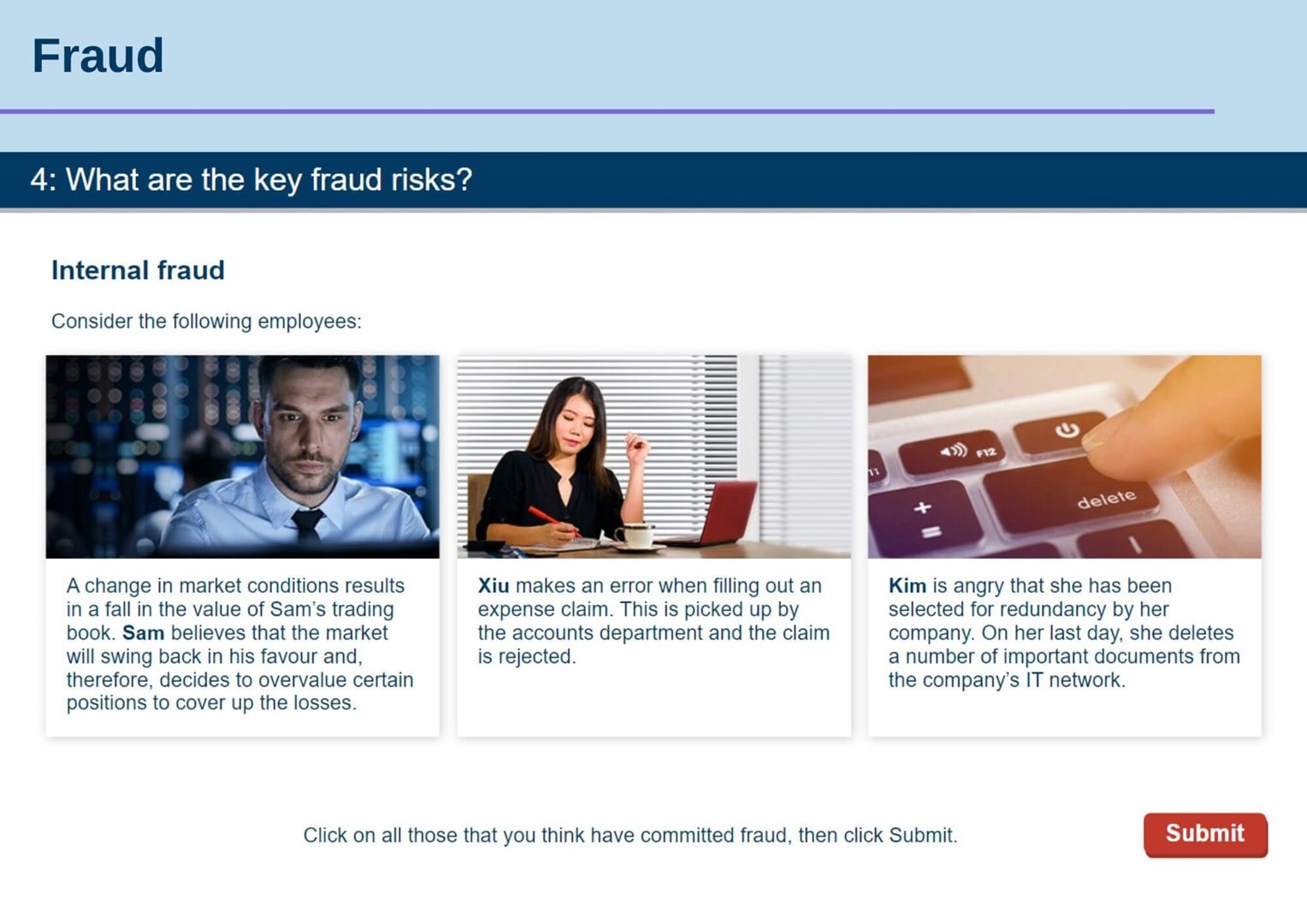

- Identifying and managing fraud risk

eLearning

You will also have access to the following eLearning modules:

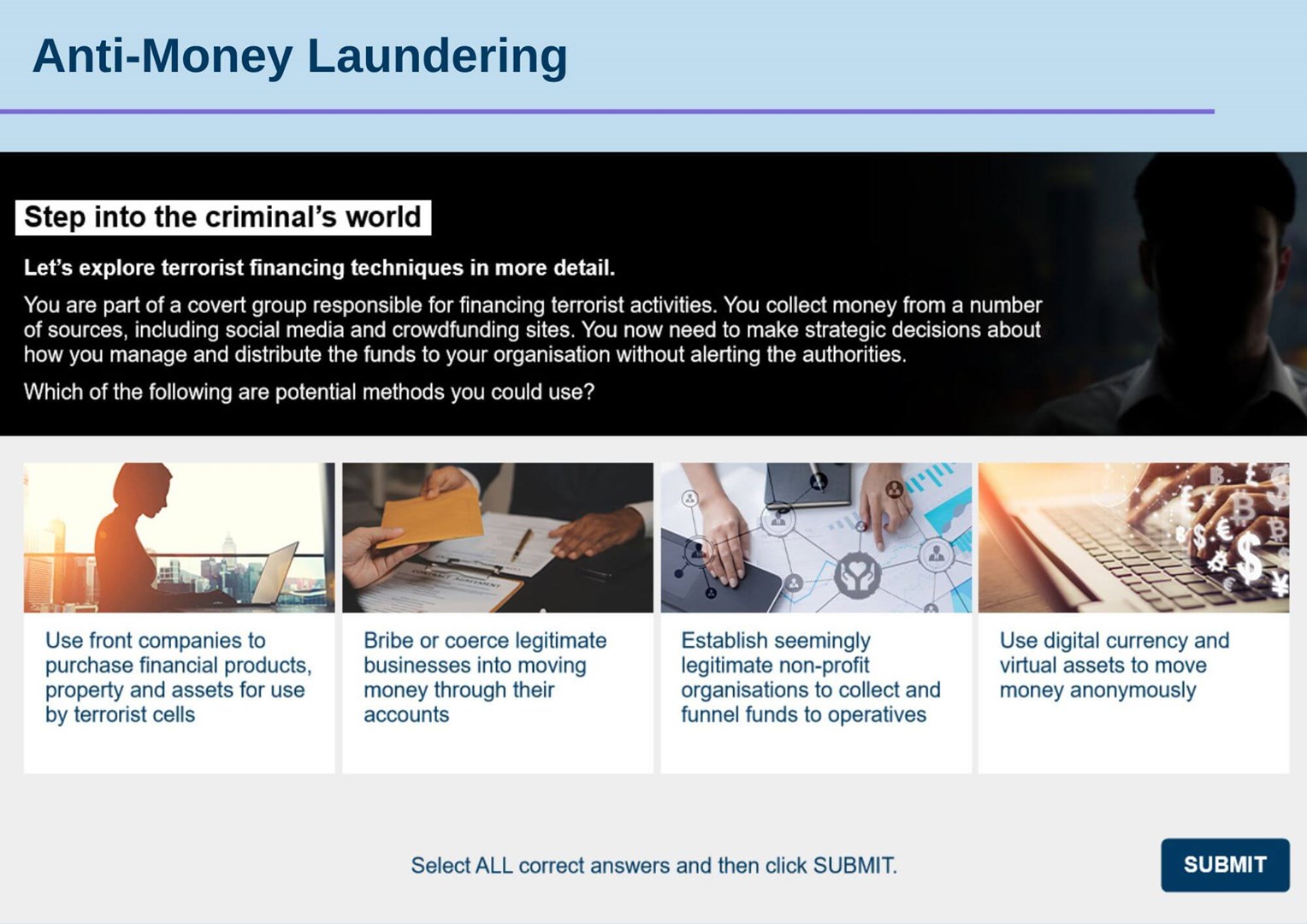

- AML Awareness

- Anti-Bribery & Corruption Awareness

- Fraud Prevention

- Sanctions

Delivery

Our interactive learning is delivered online, so all you need is an internet-connected device – we’ll do the rest.

We handle every part of the set-up process, from customising your individual Learning Management System (LMS), loading staff data, setting up a deployment and reminder schedule and reporting on progress.

In addition, administrators can also have access to all of these tools too, giving you the flexibility to be involved as much or as little as you prefer.

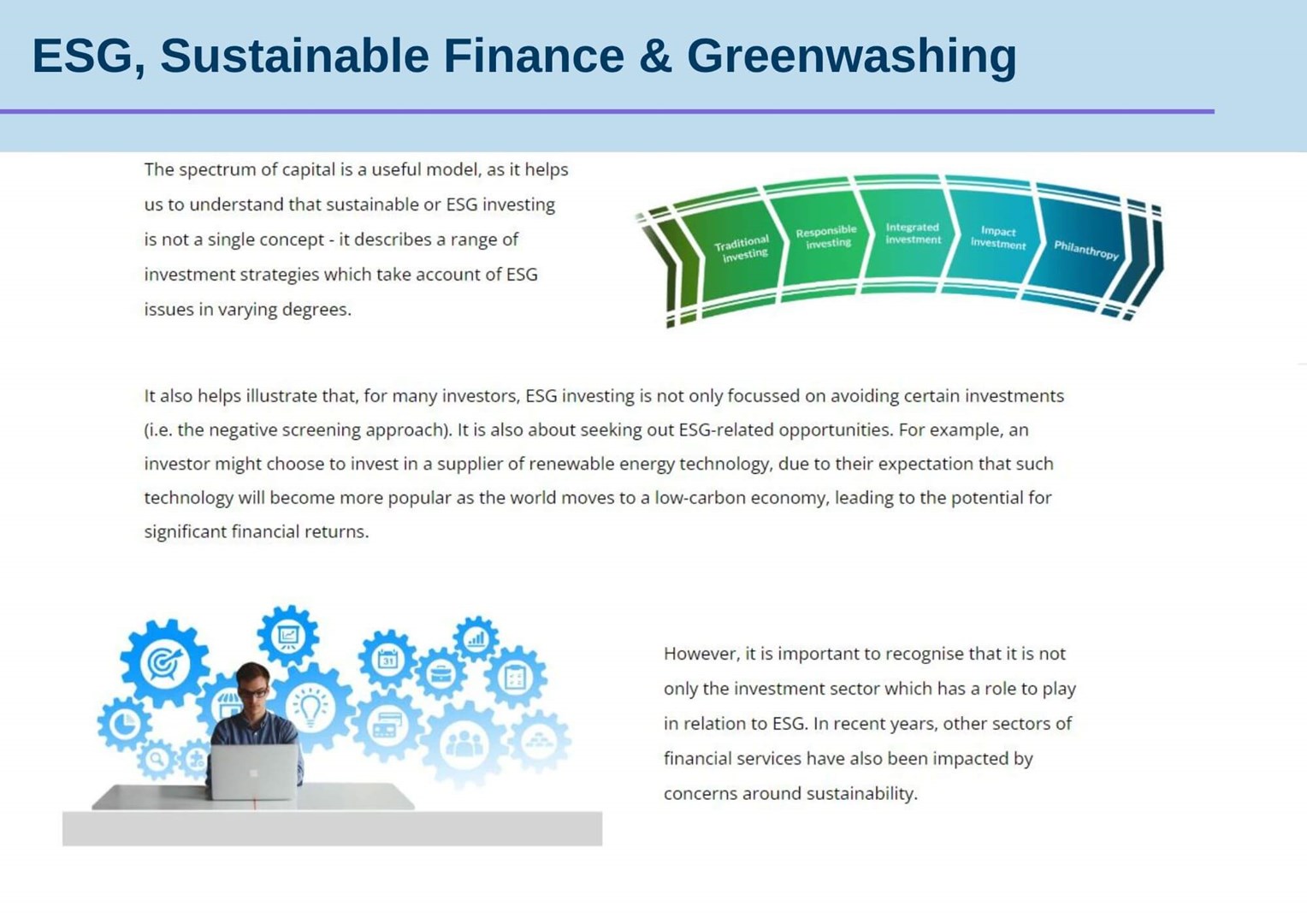

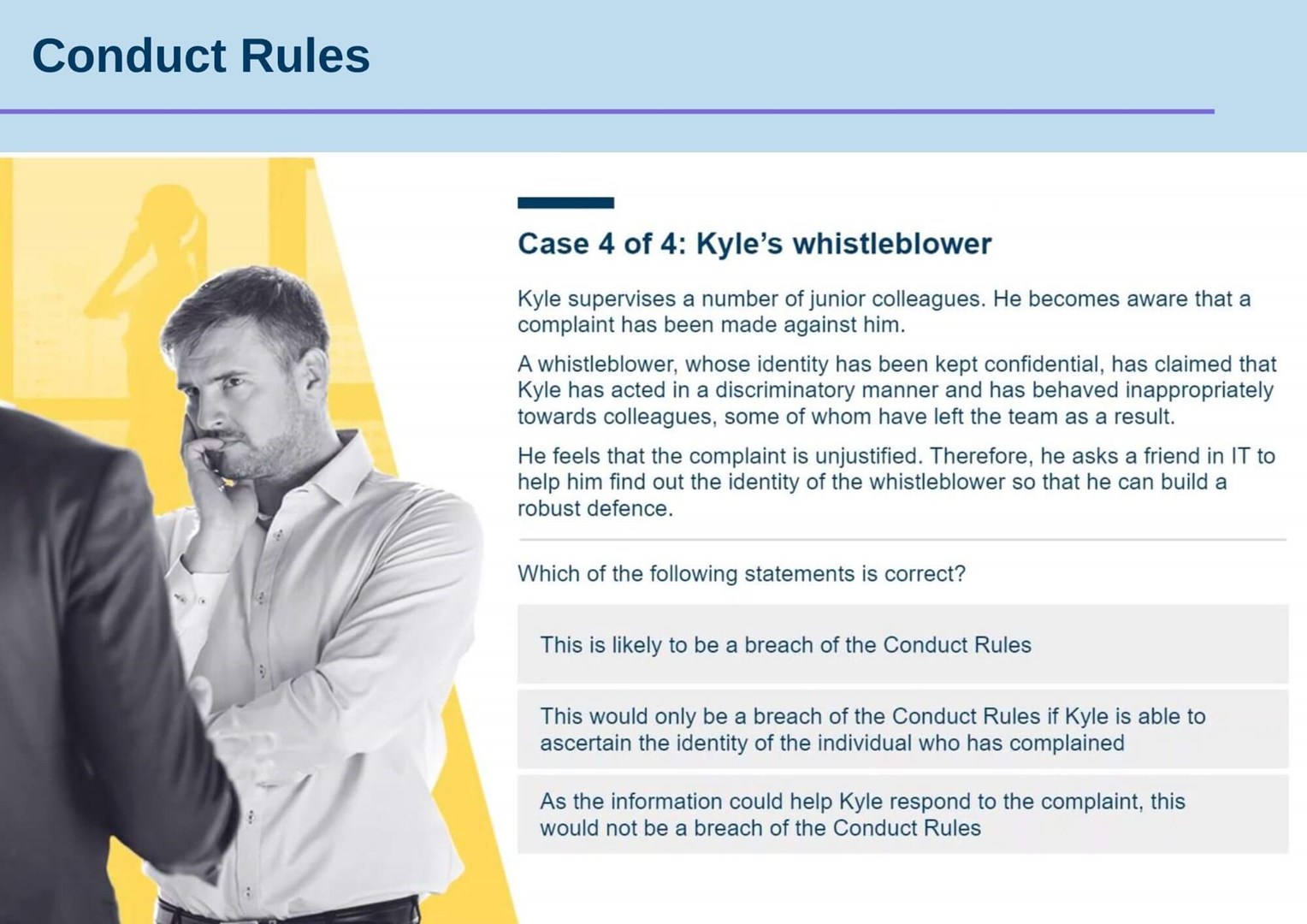

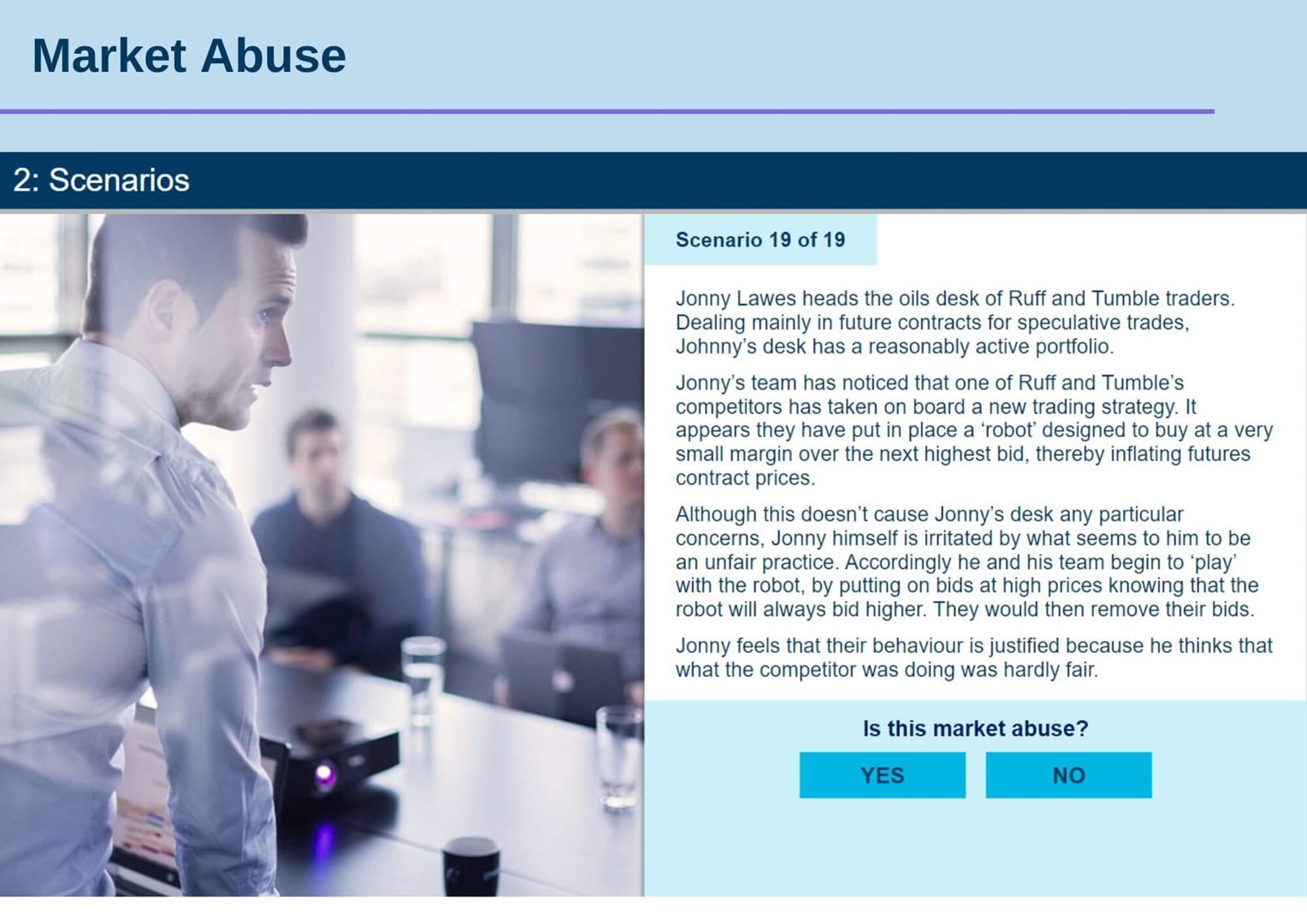

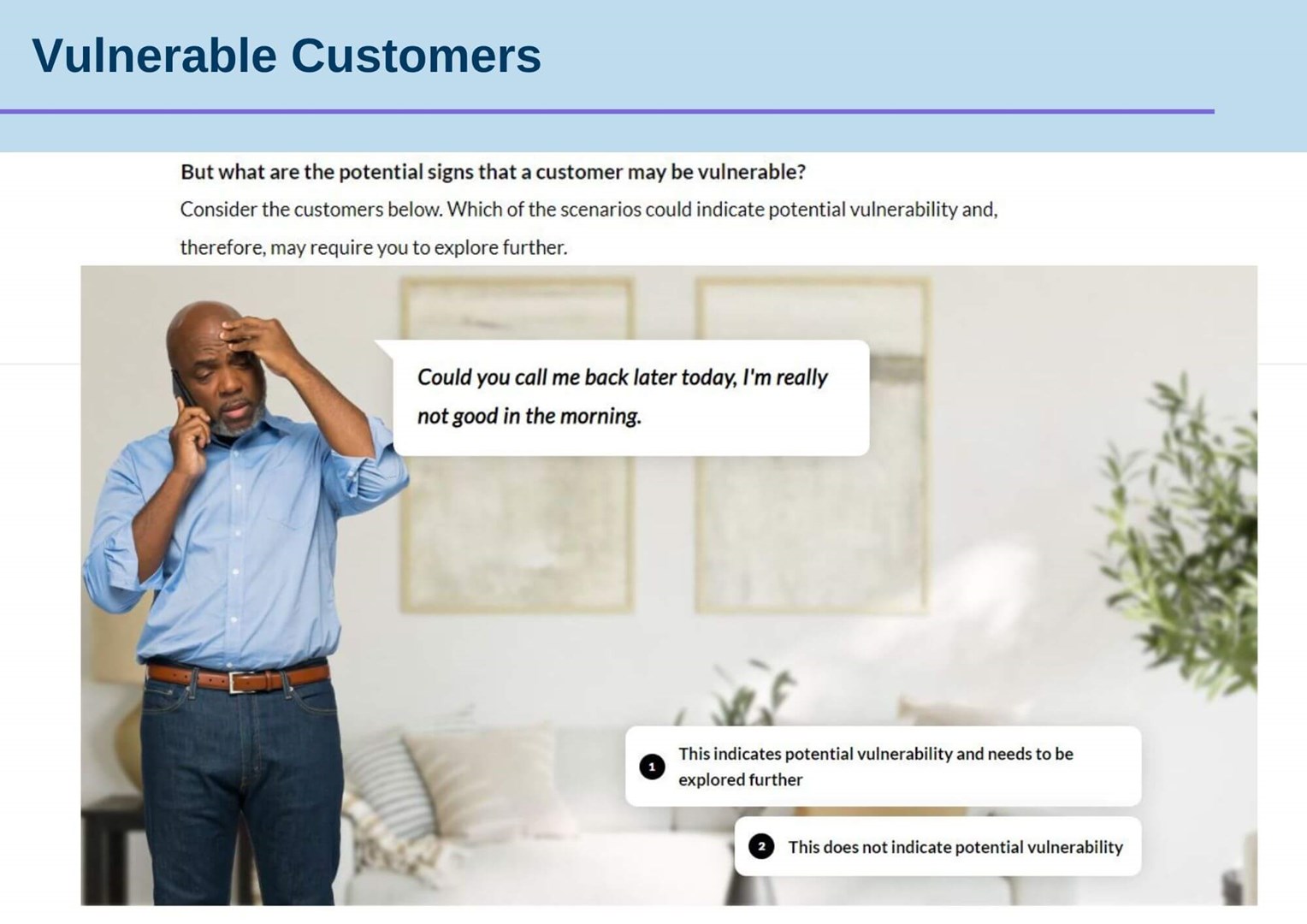

eLearning Previews

See examples taken from a range of our eLearning courses in the gallery below.